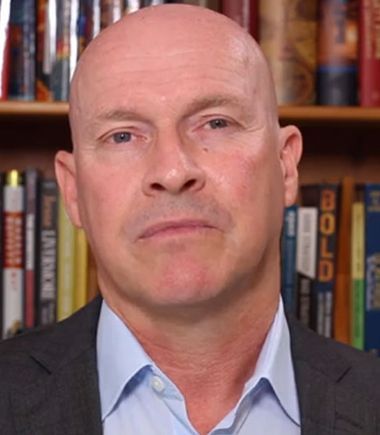

Interview with Simon Shorthose, Managing Director, Northern Europe for Kyriba

In this interview, Simon Shorthose, Managing Director, Northern Europe for Kyriba discusses the importance of ensuring control and visibility of cash and payment flows and the threat posed by outdated and inaccurate information to strategic decisions aimed at growth

TDE: Tell us about your product/business and your specific role?

Simon Shorthose: I am the Managing Director of Kyriba’s Northern European business based in London. Kyriba is a cloud-based financial management platform, enabling corporates of all types and size to optimize their liquidity performance.

TDE: What is the core issue your product/technology aims to address and what sets it apart from the other players in the market?

Simon Shorthose: Kyriba helps companies with international operations, disparate or manual processes and multiple banking relationships, to gain better control and visibility of their cash and payment flows, risk exposure and working capital management. The true SaaS, multi-tenant solution offers the full breadth of functionality in one single platform, accessible to all clients without the need for upgrades or internal reliance on IT. Bank connectivity is best-in-class, with Kyriba connecting to more banks globally than any other provider; it is also the most widely used solution of its kind, with nearly 2000 customers across the globe. So, integrated functionality, superior bank connectivity and the largest online treasury community are among the key benefits that set Kyriba apart.

TDE: What’s the one industry, sector or role that your technology is most relevant to?

Simon Shorthose: Kyriba is completely vertical agnostic, so companies of all sectors can benefit from the solution. It is typically the Finance and / or Treasury function that would use Kyriba, with IT and / or Procurement sometimes also being involved.

TDE: What are some of the common challenges your customers approach you with?

Simon Shorthose: The most typical challenge our clients face before using Kyriba is a lack of control and timely visibility of group-wide liquidity resulting from the use of spreadsheets coupled with multiple banking portals. This gives rise to strategic decisions being made based on inaccurate and outdated information, which in turn hinders growth and performance. A lack of a standardized payments processing not only compromises liquidity performance, but also exposes the company to security breaches and fraud, which is a risk our clients are often trying to mitigate.

TDE: Using technology to effect transformation usually starts with a transformation of beliefs and mindsets. How do you consult enterprise clients and help them make that important shift in mindset to move ahead on a particular project or implementation?

Simon Shorthose: With the world demanding digitalization, overcoming the mindset that a cloud solution is insecure is no longer an issue we usually face. The most common hurdle is budget, so we are equipped with a comprehensive value engineering team, whose sole purpose is to work with prospective clients to help them build a business case for investment and to illustrate anticipated return on investment.

TDE: Give us an example of an enterprise meeting a digital transformation goal through your product?

Simon Shorthose: In the case of payment leader Worldpay’s use of the Kyriba platform, with a relatively new treasury function that had to deal with enormous change both within the business and the environment in which it operates, the effect truly has been transformational. Not only has the treasury team been able to manage the growing scale and complexity of the organisation, but it also continues to leverage technology to add value to the business in new ways.

Among them, Worldpay has automated a large number of treasury processes and has daily access to accurate and complete information across its business.

TDE: What present or upcoming technologies you think have the maximum potential to accelerate enterprise digital transformation?

Simon Shorthose: The technologies that will make the most impact in enterprise digital transformation for finance executives in the near term are APIs, cross-border payments solutions and data visualization. Innovations in these three areas are accessible and practical but can make a significant impact to the bottom line. APIs are set to increase transparency into payments, and improve the rate of transactions while offering automation.

Modernization in solutions currency exchange payments will reduce fees and provide better reconciliation of cross-border payments transactions. For modern business leaders who are keen to optimize their growth strategies and minimize their operational risk, data visualization technologies gives them the ability to dynamically analyse large sets of data and turn the data into actionable insights. This is a major shift from error prone spreadsheet aggregation.

In the next five years, innovation in Artificial Intelligence, Machine Learning and Blockchain will be more integrated into the finance toolset. These technologies and their applications are still in their infancy but are being evaluated for the best application to create more intelligent finance teams.

TDE: What’s your go to resource – websites, newsletters, any other – that you use to stay in touch with the explosive changes happening in the digital space?

CTMFile, CBInsights, IDC

For more DX insights follow Simon Shorthose on LinkedIn.

By

By