A Vault or a Bank?

Joanne Moretti, Founder and CEO at JCurve Digital, explores the shifting scenario in the banking sector and new-age 'banks' of the future

"Banking is necessary. Banks are not". That was quite visionary of Mr. Gates, considering he said it nearly 3 decades ago! Today, technology and the mavericks who leverage it effectively are ripping through every major industry, including banking, making this vision a reality. And making it especially difficult for incumbents to hold their "ground". Things like 5G, mobile technologies, cloud, big data and AI to name a few, are having a major impact on:

- consumer expectations relative to how and with whom they bank, and

- the ability for new banking disruptors to innovate quickly.

Same story, different industry.

But in the case of banking, there is a 3rd major factor driving change quickly, and it is regulatory in nature. Yes, believe it or not, regulation is driving disruption, competitiveness and better customer experiences! This regulation is coming out of the EU and is known as "PSD2", an Open Banking regulation/mandate taking effect across Europe and starting to have an impact here in North America.

With a big "due date" looming for compliance by March, it's the first time ever, regulators are telling banks to "open up" instead of "tighten-down". Open up, if consumers so choose, that is. With that, an onslaught of third-party providers, whether its payments, microloans or any type of banking "micro-services" are emerging in full force, in Europe. Investors investing, partnerships forming, eco-systems developing and best of all, choices for consumers emerging. Choices laced with cool new experiences, including voice and facial recognition, wearables, you name it.

Bill’s only vision flaw is that laws and regulators require us to store money in "banks" in the traditional sense of the word (read "a protected vault"), nonetheless banking services can now come from anyone, which I believe was his real point.

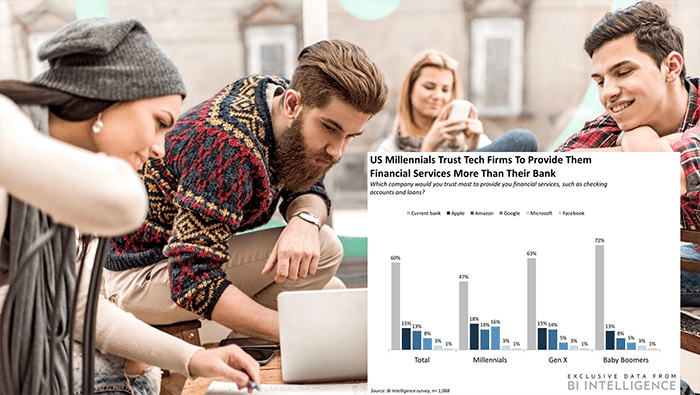

Now, while conventional wisdom has provided some comfort to traditional banks in the past, relative to their major advantage over any new third-party player i.e. TRUST, new evidence shows that younger generations, trust high tech companies more than traditional banks (big surprise there - not). Below is some data from a recent study BI Intelligence did on the topic:

Another report from Novantas, said:

almost six in ten consumers are open to Big-Tech firms such as Google, Amazon, Facebook or Apple as a banker. This represents a 14-point increase over the 2017 survey, illustrating the potential impact of a major banking product introduction by any of the major tech companies.

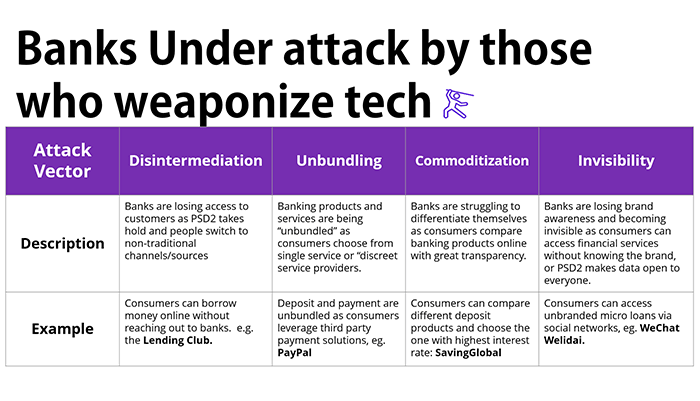

So, wisdom and overall thinking is shifting, coupled with investment dollars in technology spending to combat this attack from 3rd parties. And, while these attacks are subtly different in nature, they have a very similar and profound effect: they create separation, between a bank, and their clients. This chart shows the 4 types of "attack vectors" I see hitting traditional banks:

Many banks are starting to realize that the deeper the trust grows in tech companies, for consumers' day to day banking experiences (including paying for meals, coffee, clothes, etc.), the further removed a bank becomes from the end consumer and higher the risk of being reduced down to a "vault" . And who wants to be relegated to "vault" status and completely miss out on all types of important customer touch-points and experiences, including those of the revenue-generating variety?

So, what are you going to see as a result? A bunch of activity. From traditional banks, to startups and investments, to new partnerships and ecosystems forming. The problem right now as I see it, especially for traditional banks who are going to invest, is 5-fold:

- Fragmentation and complexity of the Fin-tech market, and the propensity to address small pain points one at a time, creating a bunch of complexity (on top of all the complexity that already exists in legacy environments).

- Speed to respond but respond with new and the right type of banking services that real human beings want - quickly. Which leads to the next point...

- Customer Experience and Design and the experiences new consumers want to have with their banks.

- Fraud, Privacy and general Risk concerns, and the bank ultimately being responsible to protect client data.

- Disinter-mediation and again, per the chart above, the risk of becoming attacked and disinter-mediated, commoditized, made invisible or worst of all, made irrelevant to your clients all together, and ending up as "the vault".

In trying to really understand what's going on from a global perspective, and trying to determine if banks can stay "connected" and "relevant" with their customers, I sat down and spoke with Paolo Spadafora, the Co-Founder/CEO of Milan-based startup: Epiphany. His perspective on the current banking landscape was very interesting, and he brought me back in time to understand it.

Paolo said: "as you know Giovanna, Italians understand a few things about banking. The financial banking system started in Florence, with the most famous bank being the Medici bank, established by Giovanni Medici in 1397. The oldest bank still in existence today is Banca Monte dei Paschi di Siena, headquartered in Siena, Italy, which has been operating continuously since 1472". He went on to explain, that his passion for helping banks thrive in this changing environment, comes from the fact that he has been working with them for over 20 years as a developer, but also he believes banks and lending in general is the economic fuel to everything; innovation, manufacturing, agriculture, human development, education, infrastructure, social and environmental advancement, communities, and basically everything. So, his take on Open Banking is that while it truly gives the consumers much more control and creates ubiquitous banking and choice, he feels that banks need to be around and thrive, to help the rest of the world function, like a well-oiled machine.

Paolo said: "as you know Giovanna, Italians understand a few things about banking. The financial banking system started in Florence, with the most famous bank being the Medici bank, established by Giovanni Medici in 1397. The oldest bank still in existence today is Banca Monte dei Paschi di Siena, headquartered in Siena, Italy, which has been operating continuously since 1472". He went on to explain, that his passion for helping banks thrive in this changing environment, comes from the fact that he has been working with them for over 20 years as a developer, but also he believes banks and lending in general is the economic fuel to everything; innovation, manufacturing, agriculture, human development, education, infrastructure, social and environmental advancement, communities, and basically everything. So, his take on Open Banking is that while it truly gives the consumers much more control and creates ubiquitous banking and choice, he feels that banks need to be around and thrive, to help the rest of the world function, like a well-oiled machine.

For this reason, this banking developer turned entrepreneur and his entire team at Epiphany are passionately focused on helping traditional banks innovate and modernize and explained that much of the work they are doing on the Epiphany platform, revolves around the 5 critical issues listed above. So, he's pretty proud of the work they are doing with a number of European banks.

Pretty cool stuff, and my team and I at JCurve Digital, are really pleased to be part of this start-up, supporting their commercial playbook.

By

By